maine excise tax credit

Excise tax is an annual local town tax paid at the Town Hall where the the vehicle resides for over six 6 months of the year. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject.

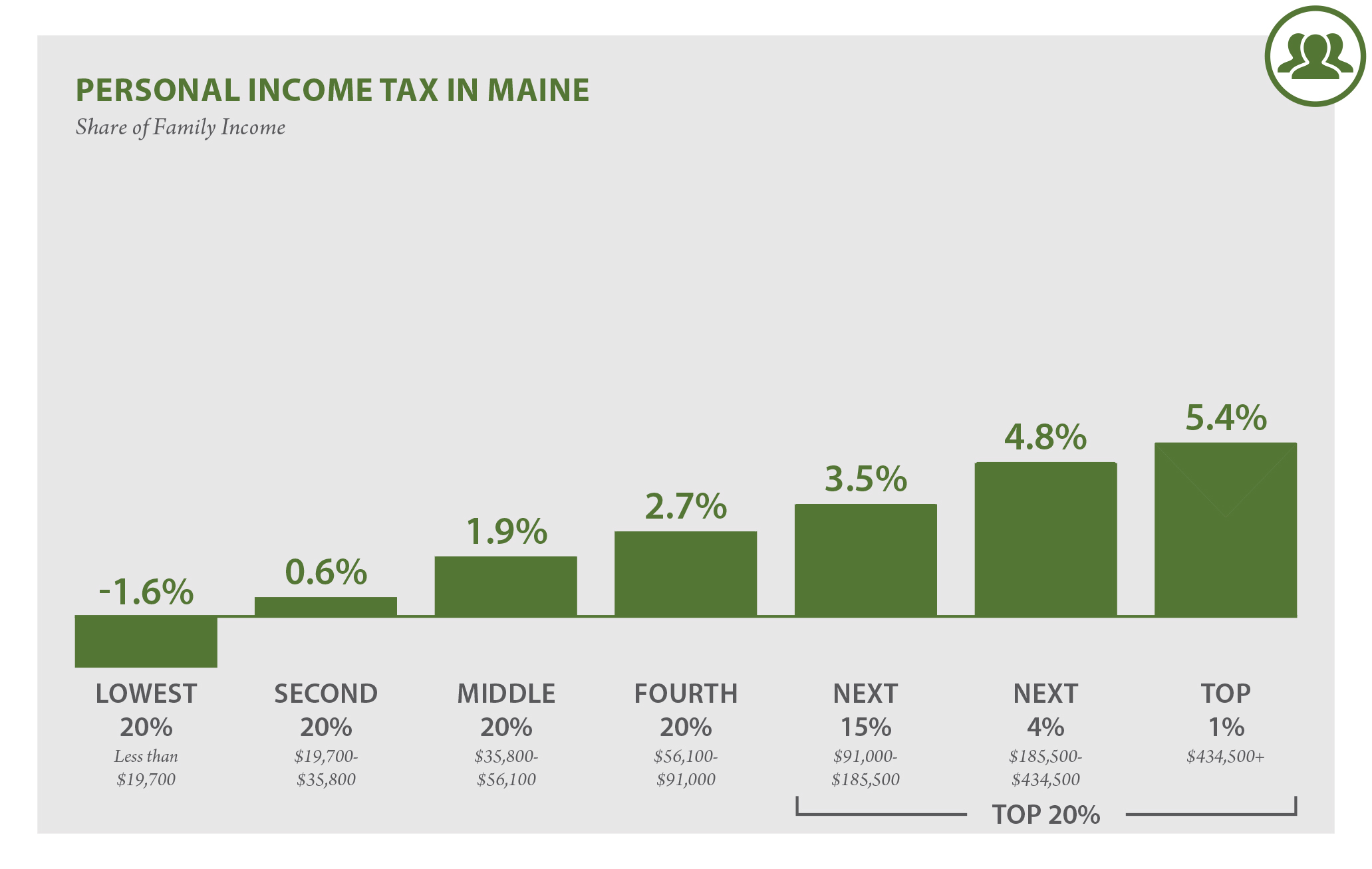

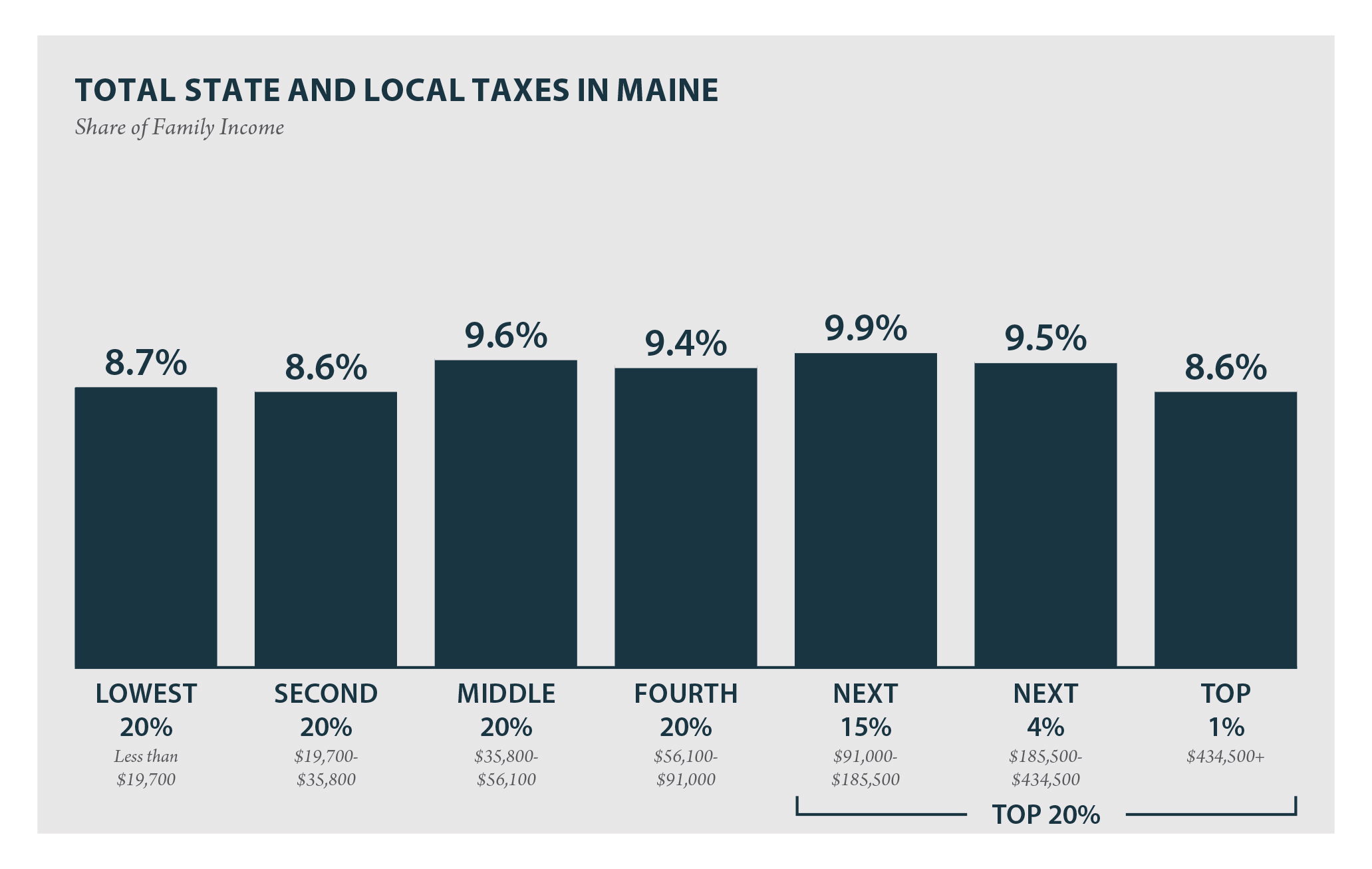

Maine Who Pays 6th Edition Itep

Excise Tax Credit Summary Report Rev.

. On - Session - 127th Maine Legislature. It says car registration isnt tax deductible in Maine. Except for a few statutory exemptions all vehicles registered in the.

The State of Maine will reimburse Municipalities for the difference between the excise tax based on the sale price and the Manufacturer Suggested Retail Price MSRP on vehicles that are. Individual Income Tax 1040ME Maine generally imposes an income tax on all individuals that have Maine-source income. Maine Revenue Services administers several programs aimed at providing eligible Maine taxpayers with tax relief.

As of August 2014 mil rates are as follows. Visit the Maine Revenue Service page for updated mil rates. An Act To Allow a Motor Vehicle Excise Tax Credit for a Vehicle No Longer in Use.

Welcome to Maine FastFile. The tax is included in the price of every gallon sold to consumers in maine. An owner or lessee who has paid the excise tax in accordance with this section or the property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward the tax for any number of vehicles regardless of the number of transfers that may be required of the owner or lessee in that registration year.

In Maine you may deduct the sales taxes paid on the purchase of a new vehicle. Excise Tax Credit Summary Report. Shall pay 3 to the place in which the excise tax is payable.

DYER LIBRARY SACO MUSEUM. Knowingly supplying false information on this form is a Class D Offense. 2021 -- 1750 per 1000 of value.

Annually the unorganized territory has tax acquired parcels that are sold via a sealed bid process. Or rather you would include it along with your other sales taxes paid in lieu of the alternative. Environmental Fees Ground Water Tax - offsite.

Maine In Focus. Excise tax is an annual type of property tax on a vehicle. Tax Relief Credits and Programs.

Individual income tax credits provide a partial refund of property tax andor rent paid during the tax. Maine Excise Tax Credit. 2022 -- 2400 per 1000 of value.

YEAR 1 0240 mil rate YEAR 2. When it comes down to Maines sales tax on cars youre only taxed on the 5000 credit not the. An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident.

How much is the credit Well the excise tax you already paid was 44100 and the excise. Narratives IFTAIRP Refund Programs. The Maine EIC is available to Maine individual income tax taxpayers who properly claim the federal earned income tax credit on federal Form 1040 or Form 1040-SR or who are otherwise.

2018 -- 650 per. Be it enacted by the People of the State of Maine as follows. According to the instructions on the Maine website you can take a.

Mil rate is the rate used to calculate excise tax. This process is administered by Maine Revenue Services. 2018 Tax Acquired Bid Packet PDF.

MAINE OFFICE OF TOURISM. 2019 -- 1000 per 1000 of value. 2020 -- 1350 per 1000 of value.

It says car registration isnt tax deductible in Maine. During the last 4 months of the registration year the credit may not exceed 12 of the maximum amount of the tax previously. Excise Tax is an annual tax that must be paid prior to registering a vehicle.

I paid excise tax on 2 vehicles. In this case the total selling price of your vehicle comes out to 8000. Calculation will be based on.

An Act To Allow a Motor Vehicle Excise Tax Credit for a Vehicle No Longer in Use. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. 2018 -- 650 per 1000 of value.

AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. The income tax rates are graduated with rates ranging from 58. WHAT IS EXCISE TAX.

Office of Tax Policy. By Maine Heritage Policy Center.

Maine Car Registration A Helpful Illustrative Guide

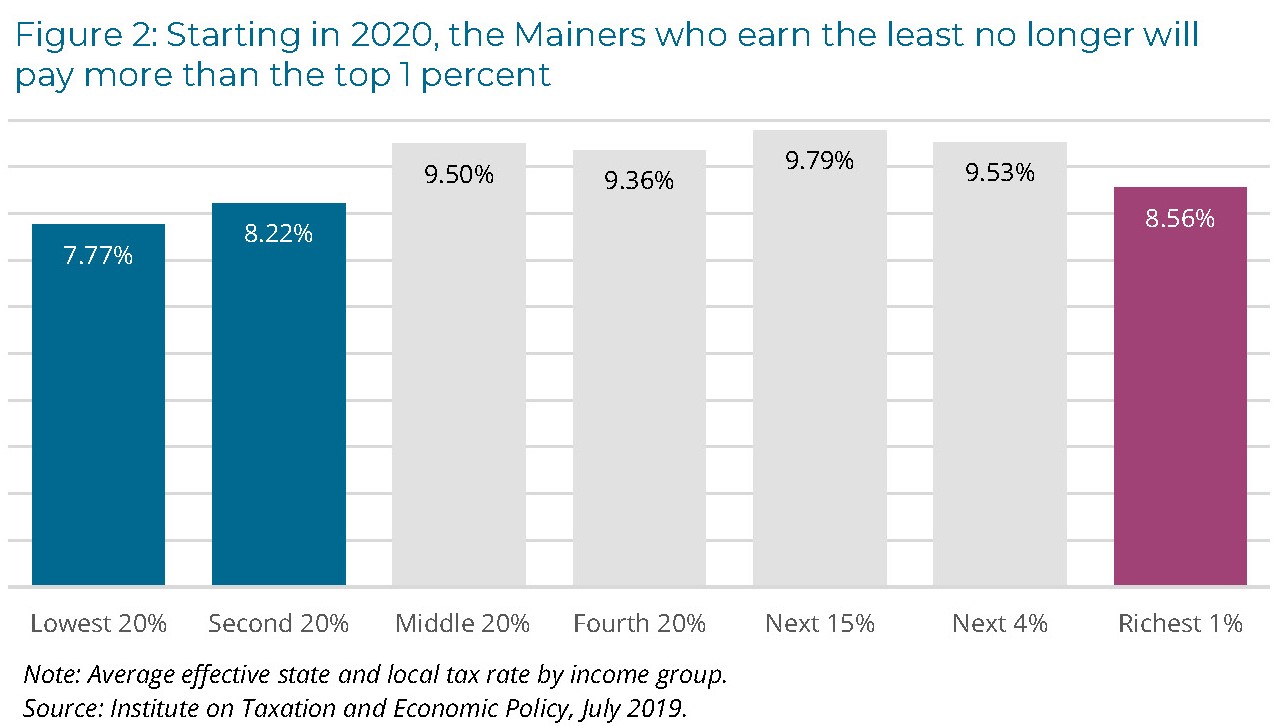

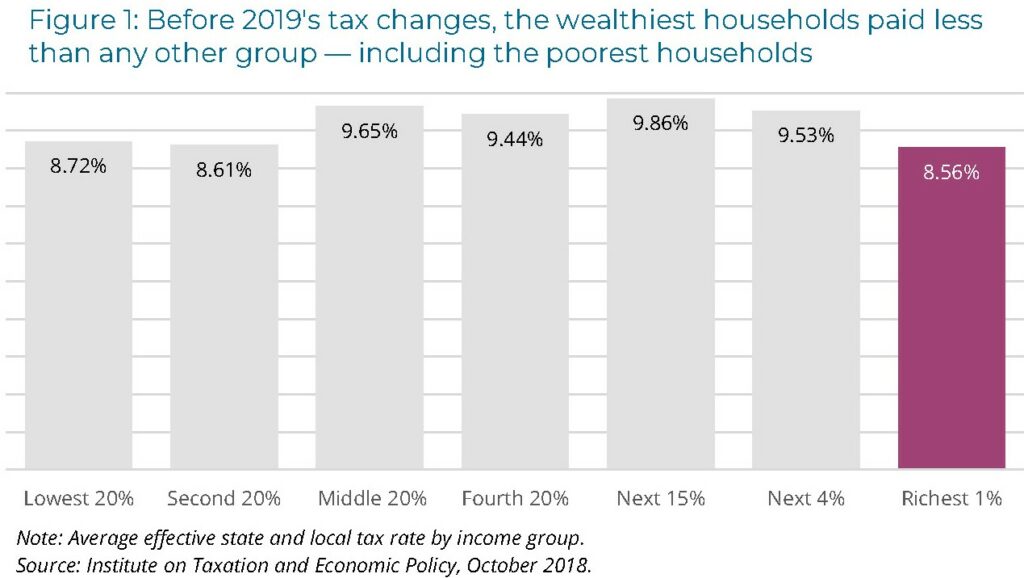

Maine Reaches Tax Fairness Milestone Itep

Maine Who Pays 6th Edition Itep

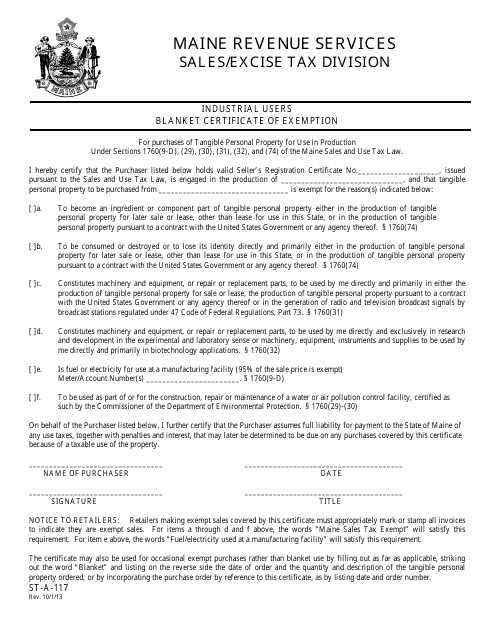

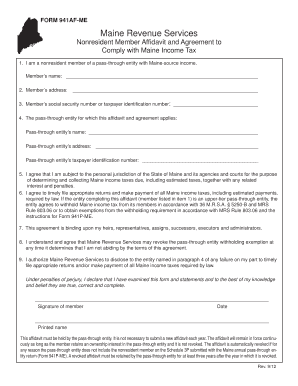

Maine Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Maine Who Pays 6th Edition Itep

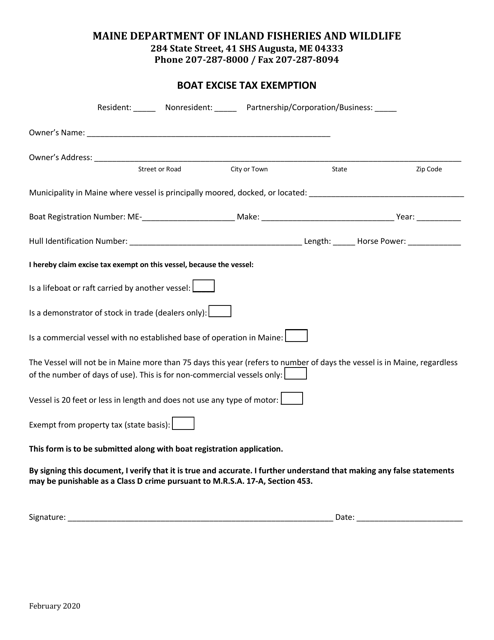

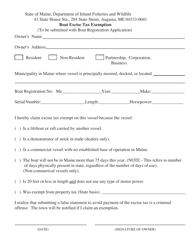

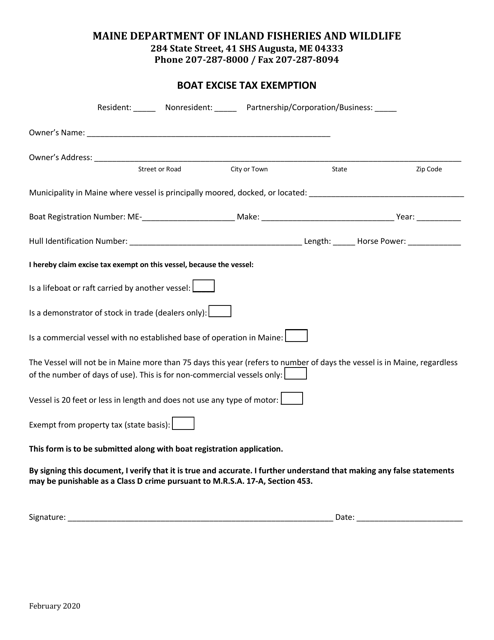

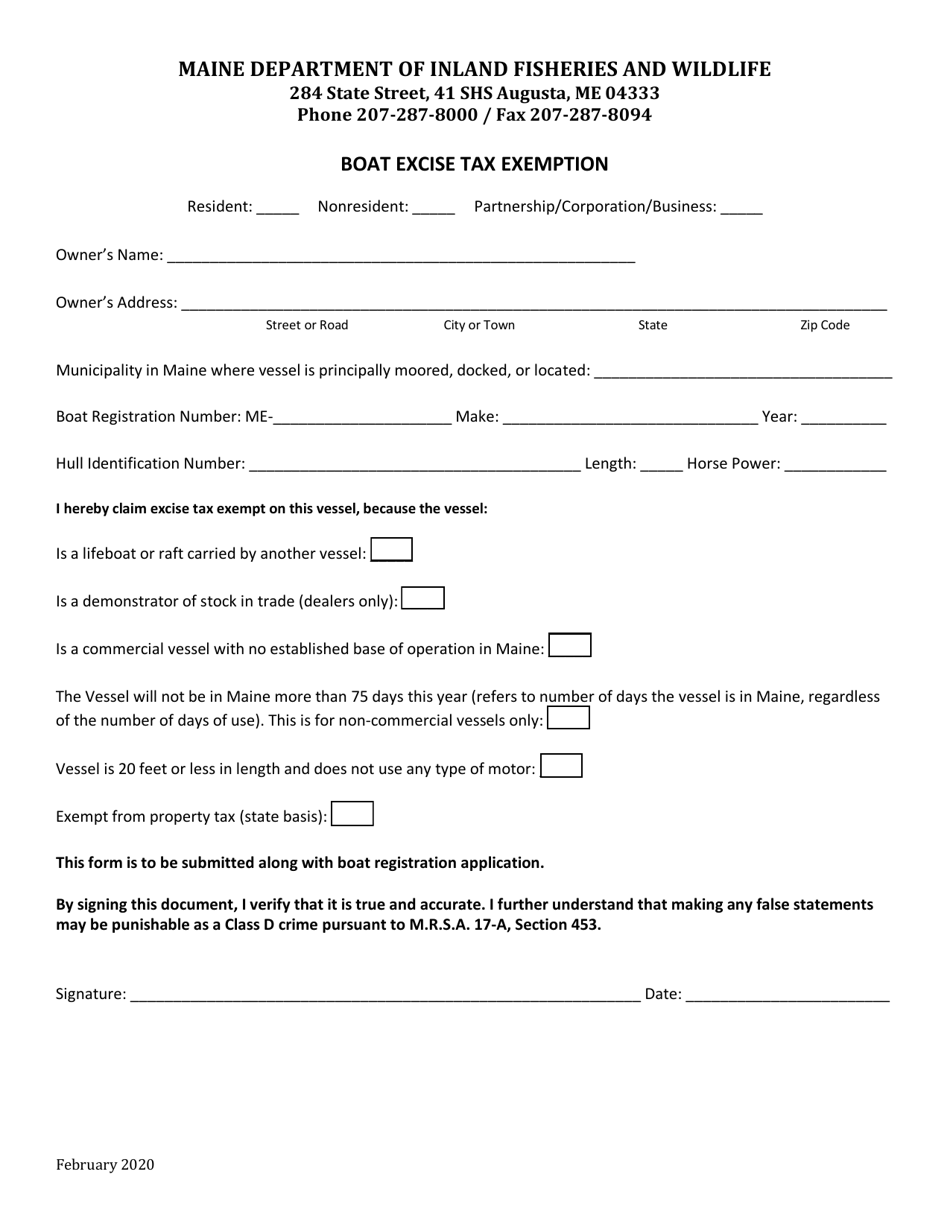

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

Excise Tax Information Cumberland Me

Maine Considers 1 000 Plug In Vehicle Credit

Free Form St P 72 Contractor Exempt Purchase Certificate Free Legal Forms Laws Com

Maine Reaches Tax Fairness Milestone Itep

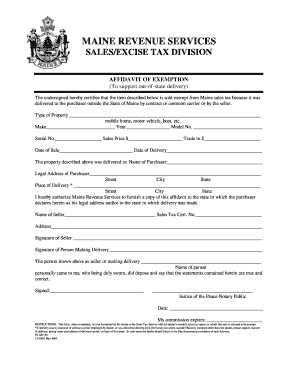

Bill Of Sale Form Maine Affidavit Of Exemption Form Templates Fillable Printable Samples For Pdf Word Pdffiller

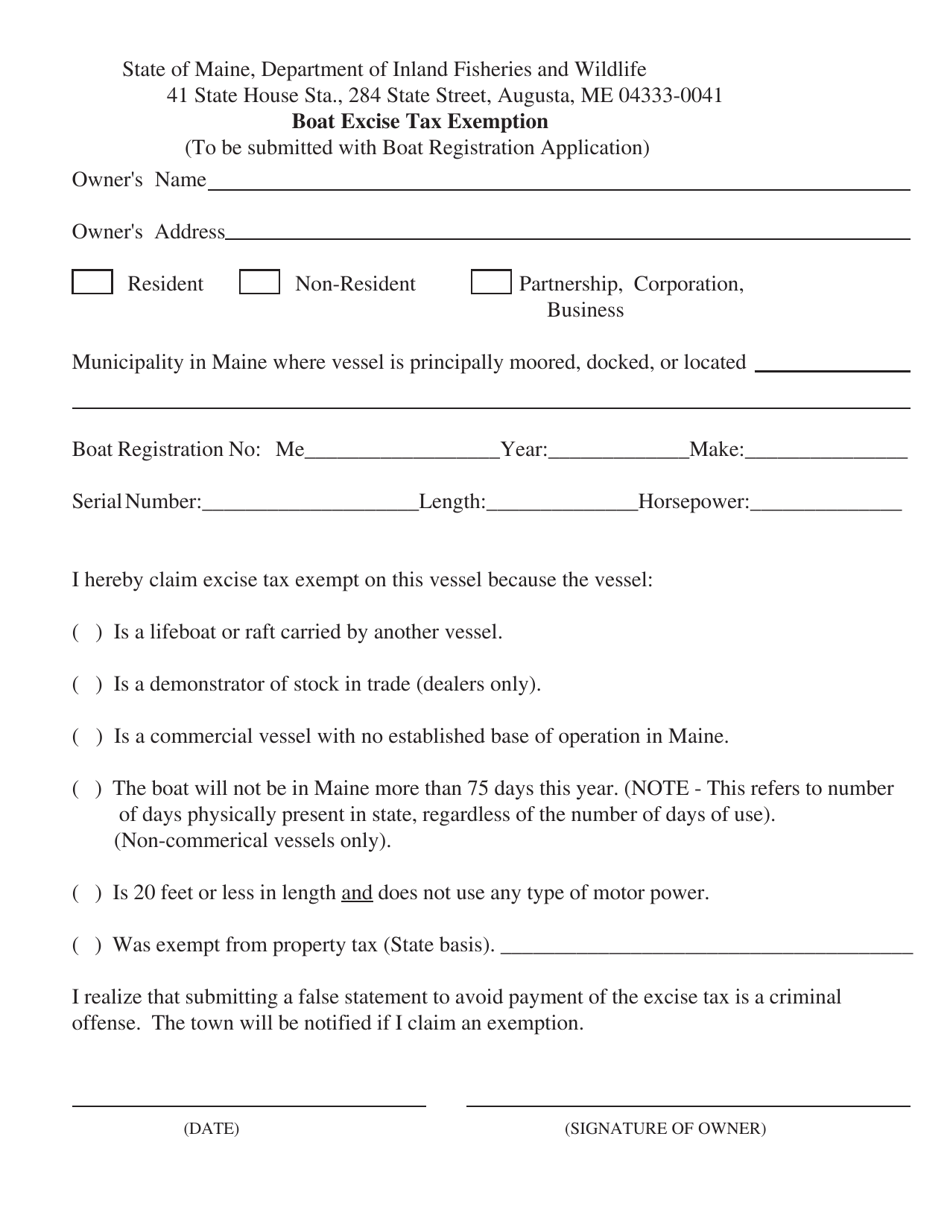

Maine Boat Excise Tax Exemption Download Fillable Pdf Templateroller

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

Bill Of Sale Form Maine Affidavit Of Exemption Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Maine Car Registration A Helpful Illustrative Guide

Maine Sales Tax On Cars Everything You Need To Know

Maine Boat Excise Tax Exemption Download Fillable Pdf Templateroller